Have you had an appointment with another solar company? Most likely they showed you a lease. They look attractive. You save money from day one and every month thereafter. What could be better? The truth is, by signing a lease, you sign away most of the benefits that come with a solar system. It's true.

By signing a lease, you allow a company to rent your roof space to produce energy that is worth a lot more than the $10 or $20 you save a month. You can add the value of a system you own to your asking price at the time of sale. In contrast, if you lease, the buyer has to qualify to assume the lease.

A lease program typically includes monthly payments that are less than your current utility bills. But often times, solar leases includes an escalator clause, causing your payments to increase as much as 2% per year. This is something to watch out for. Solar is a great way to hedge against utility inflation. Why trade one inflation rate for another?

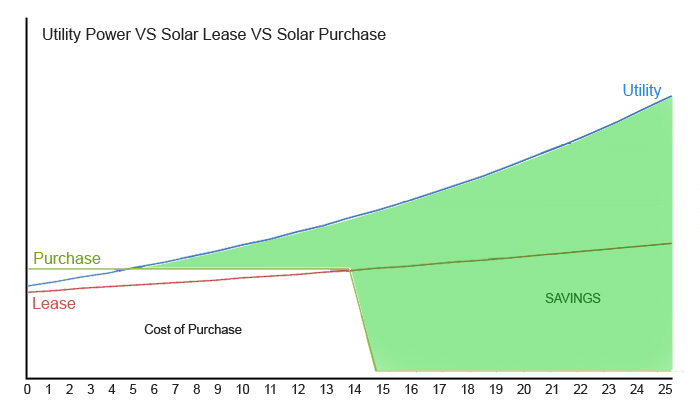

Like most leases, a solar lease has a term of 15 to 20 years. At that point, the value of the solar system is calculated and you can either purchase the system, or the installer will remove it. To bad, because a solar system can continue to save you money for a very long time. So why not purchase the system at the end of the lease? Consider the following graphs and see for yourself the savings you leave on the table with a solar lease.

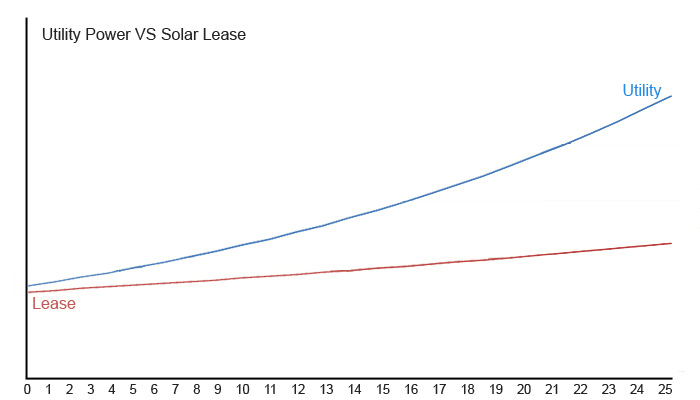

Lease payments lower your utility costs at the onset. Each year you should save more, assuming that utility inflation outgrows the escalator on the lease. For this graph, utility inflation was assumed to be 5%. The escalator is assumed to be 2%.

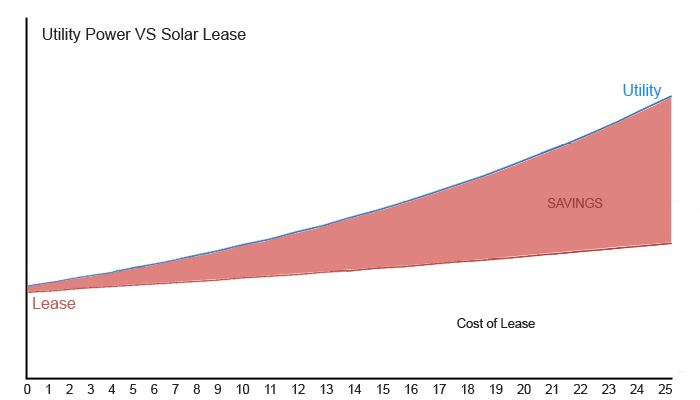

You can estimate your overall savings with a lease over 25 years as the area between the utility curve and the lease curve.

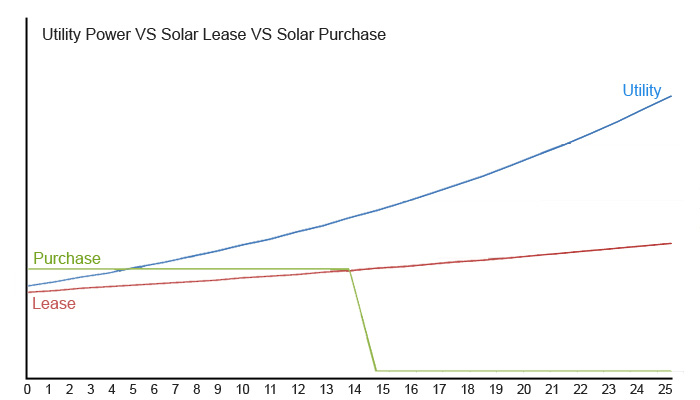

Now, let's take a look at a solar purchase.

In this example, the system is paid for in 14-15 years, and all the savings thereafter are yours. We offer many different plans to fit any budget, including interest only or no payments for a year, re-amortization after incentives are applied, no prepayment penalties and interest rates as low as 2.99% for most applicants.